Stop Guessing. Start Winning.

Unlock institutional-grade, automated strategies built on decades of academic research.

Harness the power of proven momentum, trend, and volatility algorithms to trade with confidence.

Don't Let The Next Bull Run

Leave You Behind.

Institutional algorithms profit from trends while retail traders guess. Level the playing field with the same peer-reviewed momentum strategies used by hedge funds—automated for you.

Three Pillars of Our Strategy

Trend Following

Time-series momentum strategies explain Managed Futures returns and drive the alphas of the largest managers to zero when controlled for.

Hurst, Ooi & Pedersen (2017)

Momentum Screening

Momentum documented across 12 European countries with similar magnitude as USA, showing nearly 1.5% monthly returns in top strategies.

Rouwenhorst (1998)

Volatility Management

Position sizing inversely proportional to volatility helps maintain consistent risk exposure across market conditions.

Moreira & Muir (2017)

The Market Doesn't Wait for You to Catch Up.

While you hesitate, trends are forming, compounding, and reversing. Every day you trade without a systematic edge is a day you risk being on the wrong side of the mathematical expectancy.

The Cost of "Gut Feel"

Retail traders who rely on intuition underperform the S&P 500 by an average of 4.3% annually. Over 10 years, that's a 50% difference in total wealth.

The Stockbot Difference

Platform features

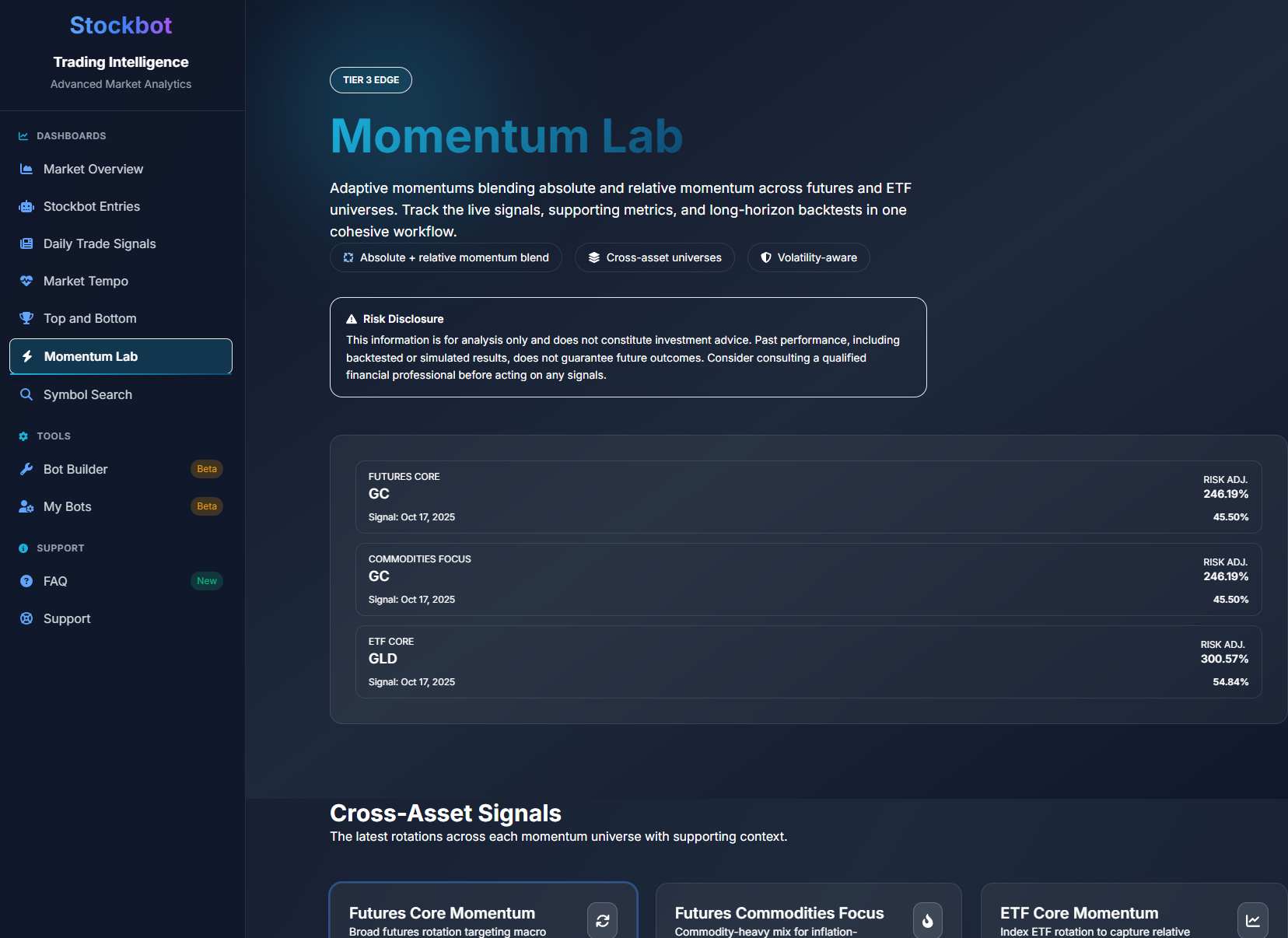

Momentum Lab

Explore relative and absolute momentum across assets, test lookbacks, and track developing leadership.

- Live futures and ETF rotation signals with risk-adjusted metrics

- Standard vs. sliding window views of current-month recommendations

- Backtested equity curves and total/annualized returns

Trading Bots Dashboard

Monitor multi‑strategy portfolios at a glance. See signal changes, exposures, and risk budgets in one place.

- Multi‑strategy and multi‑asset monitoring

- Daily signal changes and alerts

- Custom collections

Transparent Signal Details

Each signal shows the why: trend state, entry/exit markers, stops, and historical context.

- Entry/exit and confidence metrics

- Volatility‑adjusted sizing

- Risk/reward

Why Stockbot Works

The research is clear and consistent

Research-Based Algorithms

Momentum strategies have produced statistically significant positive returns across all 3-, 6-, 9-, and 12-month formation and holding periods.

Jegadeesh & Titman (1993)Daily Signals, Not Day Trading

Studies show only 3% of day traders make money, with just 1.1% earning above minimum wage. We focus on daily signals capturing longer-term momentum.

Chague et al. (2020)Futures Diversification

Time-series momentum in futures shows that trend-following speculators profit at the expense of hedgers, with managed futures explaining returns.

Moskowitz et al. (2012)Why We Focus on Long-Term Signals

Most intraday day-trading underperforms. Daily cadence reduces slippage, front-running risk, and noise — while lining up with where momentum is actually documented.

Result: Signals publish daily at end-of-day; typical holds range from days to months depending on trend persistence.

What you’ll see in a daily signal

- Directional bias (long/flat/short where supported)

- Entry/exit markers and risk budget

- Volatility-adjusted position sizing

- Trend persistence score

Access the "Crisis Alpha" Asset Class

Managed Futures (CTA) strategies are often restricted to accredited investors with minimums of $100k+. Stockbot Elite gives you the same signal logic for a fraction of the cost.

Designed for the 5% of traders ready to diversify beyond stocks and handle professional-grade volatility management.

- Diversified Trend: Equities, Bonds, Currencies, Commodities.

- Recession Ready: Strategies historically uncorrelated to the S&P 500.

Choose Your Plan

Start with a plan that fits your goals. Upgrade anytime.

Stockbot Basic Plan

- Daily Signals for Stocks

- Market Overview and Tempo

- Algorithmic Stock Picks

- Daily Entry/Exit Signals

Stockbot Pro Plan

ETF Coverage Added

All tools cover ETFs (SPY, QQQ, etc.)

New Pro Features

- Algo Bot Collections Up to 10 alerts

- Stockbot Trend Trader

- Trend Lookup & Research

Stockbot Elite Plan

Futures Coverage Added

All tools cover Futures

Elite-Only Features

- Algo Bot Collections Up to 50 alerts

- Diversified Momentum Trader

- Monthly Insider Newsletter

Detailed Feature Comparison

| Feature | Basic | Pro | Elite |

|---|---|---|---|

| Asset Class Coverage | |||

| Stocks | |||

| ETFs (SPY, QQQ, etc.) | |||

| Futures | |||

| Core Trading Tools | |||

| Market Overview | |||

| Stockbot Entries | |||

| Daily Trade Signals | |||

| Market Tempo | |||

| Market Tools | |||

| Advanced Features | |||

| Stockbot Trend Trader | |||

| Trend Lookup & Research | |||

| Algo Bot Collections | 10 alerts | 50 alerts | |

| Diversified Momentum Trader (Futures) | |||

| Monthly Insider Newsletter | |||

| Value Comparison | |||

| Typical Hedge Fund Fee | 2% + 20% | 2% + 20% | 2% + 20% |

| Stockbot Cost | Low Flat Fee | Low Flat Fee | Low Flat Fee |

The Research Behind Stockbot

Every feature is grounded in peer-reviewed academic studies

Stop Trading Against the Machines.

Start Trading With Them.

The research is done. The algorithms are running. The only variable left is you. Lock in your pricing today before our next feature rollout.

What members say

“Stockbot caught the AI breakout perfectly. My Elite plan paid for itself in just two trades.”

“The Trend Trader tool keeps it simple: buy or stand aside. Perfect for anyone with a busy career.”

“I easily built a diversified ETF bucket with Long Term Trend alerts. Total fire and forget!”

Our Transparency Pledge

- • No hype, no get-rich-quick promises, no paid courses.

- • Methods explained in plain English with links to the underlying research.

- • Trend signals, not intraday churn — because that’s what the evidence supports.

Important Information

The analysis provided by Stockbot is based on systematic trend and momentum strategies documented in academic research. This information is for educational purposes only and should not be considered financial advice.

Systematic trading strategies, including trend following and momentum approaches, may not be suitable for all investors and may not perform well in all market conditions.

Past performance of systematic trading strategies does not guarantee future results. All investment decisions should be made after careful consideration of your investment objectives, risk tolerance, and consultation with appropriate financial professionals.